Signals from China’s 2025 “Two Sessions” Plenary

28 March 2025

The People’s Republic of China is in the midst of a crisis of its own making. The EU has potential leverage over the struggling Chinese economy.

The last few weeks have been eventful, to say the least. While the new US President is doing his best to tank the American economy and engineer a baffling pivot to Russia, the People’s Republic of China quietly concluded its annual plenary assemblies, dubbed the “Two Sessions”: the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC). Every year, this event offers a small peak into the blackbox of Chinese policymaking as it gives a sense of direction for government spending lines and sets the pace for the country’s economic outlook.

Dwindling Growth and Disenchanted Youth

The Two Sessions is a highly orchestrated political event that brings together thousands of delegates from across the country including ethnic minorities who sit in the NPC and the CPPCC. The NPC is the main legislative body in the country but has traditionally acted as a rubber-stamping assembly for the will of the Chinese Communist Party (CCP). The main purpose of the session of the Consultative Conference, on the other hand, is to represents various parts of China’s civil society, business and cultural elite. This advisory body was cleverly designed to have a finger on the pulse of the wider Chinese public, as well as keep its problems and potential grievances private.

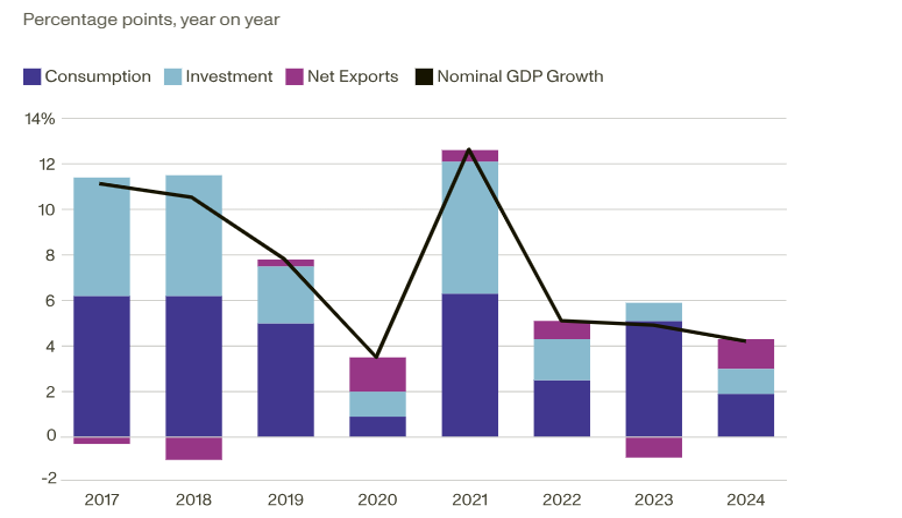

And grievances there are. After years of substantial economic growth, the Chinese economy is struggling to stay on top of the state-led targets. In 2024, official figures cite 5 % GDP growth, while certain Chinese economists question these numbers as deliberately overstated by the CCP (Fig. 1). Independent research providers like the Rhodium group estimate that the actual growth in 2024 was between 2.4 to 2.8 %, i.e., drastically different than the official figures. This year’s Government Work Report aims at “around 5 % of GDP growth for 2025”, along with a number of other internal targets on new urban jobs, grain output and energy consumption. Heavy doubts remain whether this year the economy can register healthy growth rates.

Figure 1: Annual Chinese GDP Growth (2017-2024, in real terms)

The biggest puzzle for Beijing is how to stimulate internal demand and make its population spend more. The monumental real estate property bust still has ripple effects across China as losses to investors are measured in the hundreds of billions of dollars and counting. With their property depreciating and limited trustworthy investment opportunities within the country, Chinese citizens prefer to save rather than invest into a slowing and ageing economy. For more than a year China has also suffered from deflation, which makes users purchase less in anticipation for even lower prices. The lack of a welfare state and growing geopolitical uncertainty have made the Chinese population specifically risk-averse, with more and more money going under the mattress (Fig. 2).

Figure 2: Savings rate (%), major economies

Negative sentiment is specifically pronounced in the 18–35 years old cohort, as they struggle to find good employment opportunities and are far from the wave of optimism enjoyed by preceding generations. Strikingly, youth unemployment in China is literally off the charts – it reached 20 % in 2023, before the government started to manipulate the statistics and even stopped reporting it altogether. Unsurprisingly, this is reflected in the dire demographic trends within the country and a growing culture of disenchanted youth who are struggling to find stability and purpose.

It is important to stress that the biggest aim of the Communist Party and its whole governance approach displayed at the Two Sessions has always been about raising living standards, providing high economic output and a positive outlook for society at large. This is the fundamental civil contract in Chinese society, even though it is governed by a highly repressive party-state. The last few years have made this pact shaky.

Modest Stimulus but No Bazooka

Apart from the elusive “around 5%” growth, this year’s Government Report also announced a budget deficit target of “around 4%” of GDP, increasing from 3% last year. The government will provide a widened fiscal package with different streams of subsidies for purchases of mid-range electronics and home appliances, as well as a bigger financial facility for local government bonds in order to help out the struggling local authorities. This is of key importance, as in the last few years rising public and hidden debt in Chinese local government coffers has spiralled out of control and further exacerbates the economic slowdown.

This stimulus is a positive signal for investors, but doubts remain whether these limited measures can spur internal demand. In parallel, the escalating tariff war by the US has put pressure on a number of economic sectors and threatens Chinese export margins. It is far from certain whether China will generate the same high export figures in 2025, especially as a number of other global trading partners are re-considering their trade balances with China or exploring de-risking options.

Apart from the new limited stimulus, Chinese state-planners also want to kindle “emerging industries and industries of the future” like biomanufacturing, quantum computing, improved general purpose AI capabilities and 6G technology. A new 1 trillion-yuan (130 billion euro) fund has been set up to provide state support in select AI industries. Beijing aims to further China’s pursuit of technological prominence and self-sufficiency. This is an essential goal for the Chinese governing party, especially given the aggressive US posture on technological competition and severe export control restrictions on advanced semiconductors and manufacturing equipment.

While many observers perceive China as a technological superpower with unlimited growth potential, the reality is that high-tech manufacturing and the digital services sector represent only 20% of recent economic growth (Fig. 3). A recent RAND report makes the case that the “old economy” of traditional goods and manufacturing items is the actual pillar of the Chinese economy, but the one which is stagnating. China is economically slowing and technologically advancing. Both are true at the same time.

Figure 3: “Old Economy” Growth vs. New Economy

The one undisputed budget line remains the military. At the Two Sessions, the government re-confirmed an increase of the country’s defence budget of 7.2 %, edging to 240 billion euros, the second biggest globally. These figures are mired in confusion and purposeful under-reporting as Beijing wants to hide its actual capabilities which are probably 30 to 40 percent higher than stated in the official budget. Not to mention the fact that additional defence spending is hidden in the internal budget lines for “domestic security” as China relentlessly invests in improving its defence capabilities and military preparedeness.

European Union Optics

The European Union needs to resist the temptation to quickly thaw its relationship with China, given the political storm across the Atlantic. Spain’s Socialist government already unwisely announced that Brussels should approach Beijing differently. Ongoing Chinese deflation and cheaper Chinese goods are becoming appealing for European markets, which are already flooded by Chinese goods.

The European Union cannot continue to act as a dumping ground for China’s manufacturing overcapacity, while Beijing remains a strategic competitor and an enabler of Russia’s aggression in Ukraine. Not to mention that trade coercion, active discrimination of European business and the permanent theft of Western intellectual property are just part of the day-to-day when dealing with China.

It is clear that China’s exports are keeping its economy going, but this also requires huge export markets to keep absorbing the huge Chinese supply. EU member states need to collectively use this as leverage, given that Beijing will rely even more and more on Europe’s affluent market given the US’ belligerent detachment. It still holds true that the transatlantic Alliance continues to have overlapping strategic trade and security goals vis-à-vis China. Should European leaders provide unity and strategic depth, China can even be used as a trump card in dealing with the US administration.

Even though squeezed from both sides, this is a generational opportunity for the EU to seriously re-valuate its dependencies and strategic vulnerabilities coming both from the US and China. The Two Sessions clearly signal that the Chinese economy is slowing down, but the state is alert and pre-occupied to responding to US’ trade and tech war.

There won’t be a better time for European member states to purge their critical infrastructure from Chinese unsafe vendors, re-balance their trade deficits or double down on European businesses’ access to Chinese markets. Perhaps be bold enough to consider banning TikTok and limiting imports of highly subsidised solar panels, batteries and Electric vehicles, which are killing European industry.

After all, what was the old Chinese saying about opportunities coming from a crisis?

ENJOYING THIS CONTENT